Risk-Reward Ratio in Forex

Learn How to Calculate and Apply

Introducing

Risk management is a critical aspect of forex trading. One of the most significant metrics that traders use to balance risk and reward is the risk-reward ratio. This ratio helps traders make informed decisions by comparing potential gains with potential losses. In the realm of algorithmic trading, the risk-reward ratio is a fundamental concept that provides a structure for effective, systematic decision-making.

Understanding Risk-Reward Ratio

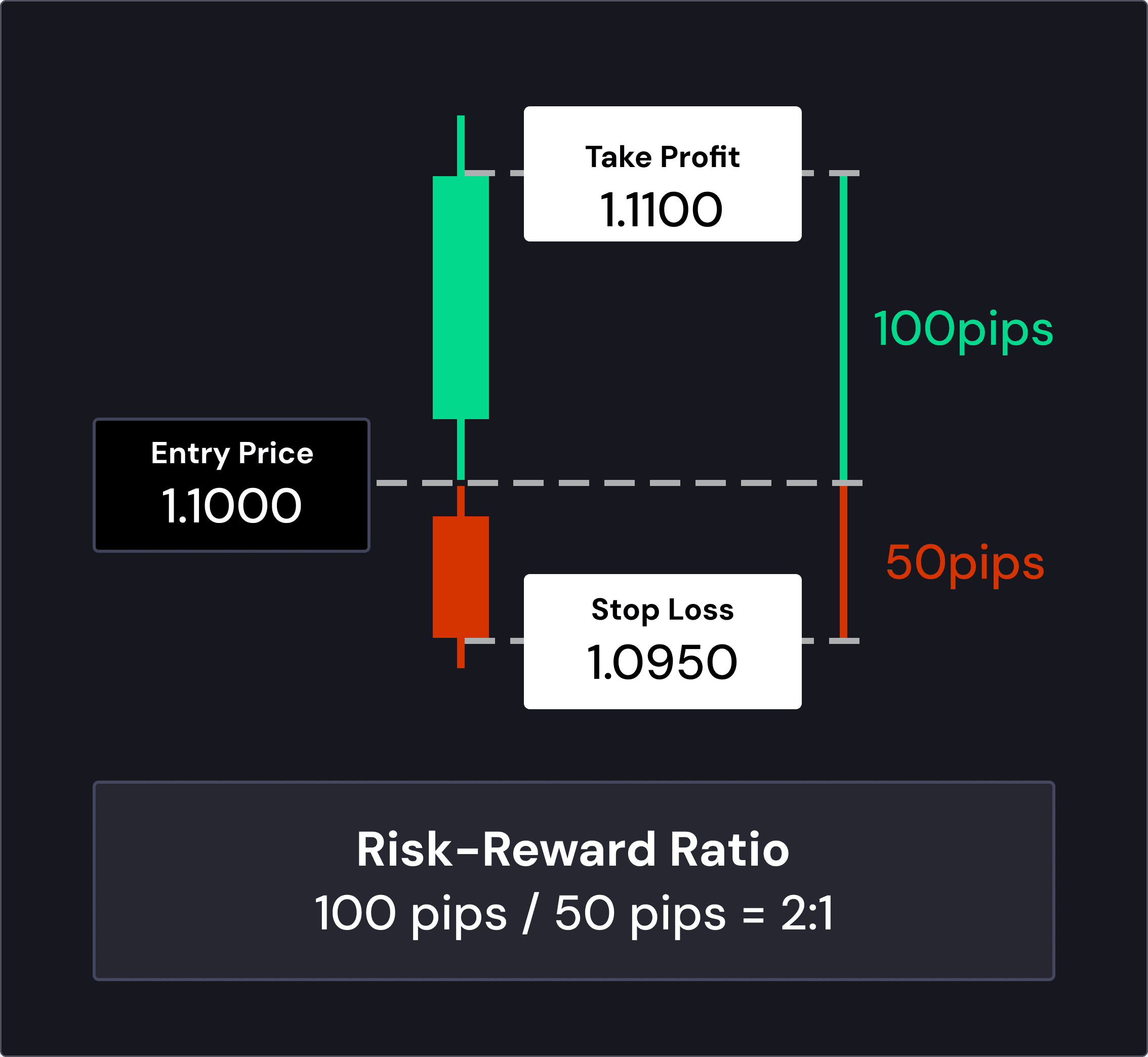

The risk-reward ratio compares the amount of risk taken to achieve a particular reward. For instance, if a trade risks 50 pips to earn a potential reward of 100 pips, the risk-reward ratio is 1:2. The components are:

Risk

The potential loss if the trade moves against you.

Reward

The potential gain if the trade moves in your favor.

Common risk-reward ratios include 1:1, 1:2, and 1:3. These ratios influence trading decisions because they determine the trade's profitability threshold. For example, a 1:3 ratio means a trader would risk one unit of currency for the chance to gain three units.

Calculating the Risk-Reward Ratio

There are several methods to determine the optimal position size in Forex trading:

Identify the entry price and stop-loss level, which will determine your maximum potential loss.

Choose a take-profit target based on market analysis to establish the potential gain.

Subtract the stop-loss level from the entry price to find the pip difference, representing the amount at risk.

Subtract the entry price from the take-profit level to determine the potential profit.

Divide the reward by the risk.

Example

Entry Price: 1.1000

Stop-loss: 1.0950 (Risk = 1.1000 - 1.0950 = 50 pips)

Take-Profit: 1.1100 (Reward = 1.1100 - 1.1000 = 100 pips)

Risk-Reward Ratio: 100 pips / 50 pips = 2:1

Application in Forex Trading

Determining the appropriate risk-reward ratio for specific trading strategies requires consideration of various factors:

Different strategies might require different ratios. For example, scalping strategies might benefit from a 1:1 ratio, while swing trading might aim for 1:3 or higher.

Some traders mistakenly set overly ambitious targets or too-tight stop-loss levels, skewing the ratio in a counterproductive manner.

Expert advisors (trading algorithms) can optimize these ratios based on historical data and prevailing market conditions.

Risk Management and Strategy Optimization

The risk-reward ratio is vital for managing the overall portfolio risk. By carefully selecting trades with favorable ratios, traders can improve long-term profitability. Integrating the ratio into trading algorithms helps make decisions more consistent and data-driven.

Strategies can be optimized by:

Testing historical data to identify setups with historically favorable ratios.

Refining algorithms to focus on ratios that align with a trader’s risk tolerance and objectives.

Conclusion

The risk-reward ratio plays a crucial role in achieving long-term profitability in forex trading, and traders who consistently apply these principles stand a better chance of success. Those using algorithmic trading can further enhance their results by completely automating this process.

Start Trading Now

Ready to improve your trading strategies with expert algorithms? Explore Enigma Algo’s automated trading solutions today for better risk management and strategy optimization.